Content

This figure represents the sum of two separate line items, which are added together and checked against a company’s total assets. This figure must match total assets to ensure a balance sheet is properly balanced. It indicates the profitability of a business, relating the total business revenue to the amount of investment committed to earning that income.

With a qualified team of Chartered Accountants and finance outsource specialists we’re dedicatedly providing reliable, timely, and affordable services which businesses in UK can trust. Our motive is simple; offer best outsource accounting services and help the business houses invest more time in growing. The Ad-hoc model of outsourcing is more suited for practices with inconsistent or undefined workflows. This is the second most popular engagement model for accounting outsourcing services after the FTE solution. As the name suggests, the outsourcing company provides an offshore accountant to a practice on an ad-hoc basis as a requirement arises. Mindspace Outsourcing Ltd. provides online accounting services, outsourced bookkeeping, online bookkeeping, and other outsourced financial services to UK businesses.

Self Employed Accounting

While the importance of bookkeeping cannot be understated given how crucial a part it plays in the accounting of day-to-day transactions and filing at the end of the financial year. However, it is not exactly the most rewarding facet of running a firm, since it does not really generate revenue or facilitate growth on the business side of things. In a nutshell, bookkeeping can sometimes throw a spanner in the works and keep you from focusing on the things you love and do best, which includes expanding your business. Flatworld Solutions is a leading provider of cost accounting solutions and can help you with a wide range of cost accounting requirements. We help clients obtain timely and actionable insights that help them focus on business drivers and optimize the available capacity such as people, infrastructure, and resources. We also provide insights related to increased cost transparency that helps to identify inefficiencies. IBN’s 22+ Years of Bookkeeping experience helps you get a revenue boost by saving on finance and accounting overhead costs up to 50%.

Top accounting outsourcing companies, therefore, provide custom pricing to clients based on their exact needs. However, there are certain engagement models for UK accounting outsourcing that accountancy firms widely prefer. Outsourcing is among the most effective ways for accounting practices and accountants to grow quickly during periods of uncertainty and also introduce new services to their clients. Outsourcing allows firms to reduce their overheads and helps make their everyday processes more efficient and quicker. To gain these benefits and build capacity for their business, many accounting firms are looking tooutsource accounting servicesacross the UK.

Do you want a dedicated team?

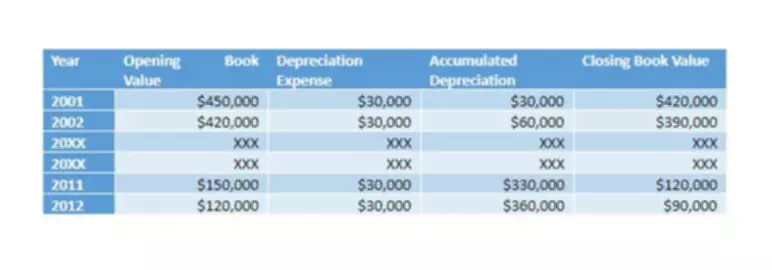

Examples of such items are plant, equipment, patents, goodwill, etc. Valuation of net fixed assets is the recorded net value of accumulated depreciation, amortization and depletion. This figure expresses the average number of days that receivables are outstanding. Generally, the greater the number of days outstanding, the greater the probability of delinquencies in accounts receivable. A comparison of this ratio may indicate the extent of a company’s control over credit and collections. However, companies within the same industry may have different terms offered to customers, which must be considered. We have experience in handling the corporation tax requirements of several companies in the UK.

- The Block of Hours Model is similar to the Ad-hoc model in terms of process, benefits, and challenges.

- There were some initial hic-ups as I am very particular about providing high-quality services to my clients.

- Because it reflects the ability to finance current operations, working capital is a measure of the margin of protection for current creditors.

- We provide a range of dedicated outsourcing services to support your business with its day-to-day accounting needs.

- Valuation of net fixed assets is the recorded net value of accumulated depreciation, amortization and depletion.

Taxes can keep accounting businesses up at night, especially during tax season. Your firm works overtime to prepare and file taxes on time to avoid late payment penalties.

SciFi Laboratory Interior Design 3D Model

Our automation solutions enable clients to accelerate their digital transformation journey, while optimizing the use of your existing IT landscape. Built by leveraging our in-depth operational experience and automation expertise, our solutions are customized to achieve your specific business objectives. Demonstrated specialisation in handling bookkeeping needs of accounting practices and CPA firms. This percentage represents obligations that are not reasonably expected to be liquidated within the normal operating cycle of the business but, instead, are payable at some date beyond that time. This percentage represents obligations that are expected to be paid within one year, or within the normal operating cycle, whichever is longer. Current liabilities are generally paid out of current assets or through creation of other current liabilities.

4 Questions to Ask If You’re Waffling Between In-House and Outsourced Accounting – CEOWORLD magazine

4 Questions to Ask If You’re Waffling Between In-House and Outsourced Accounting.

Posted: Thu, 28 Jul 2022 07:00:00 GMT [source]

Here, all costs of a product’s manufacture excluding material and labor costs are called overhead costs. We determine the fixed and variable overhead costs and emphasize minimizing the variable costs to maximize the profits. Reduce operational costs by ensuring superior service quality in medical billing & coding, outsourced bookkeeping solutions pharmacy, transcription, & teleradiology, etc. With the assistance of automation, the businesses prevailing in the hospitality sector not only streamline their business well, but additionally eliminate their overhead costs from the business. We customize financial reports according to needs of our clients.

All you have to do is send us your income related documents through our secure FTP and leave the rest to us. Our project accounting services can help you compare your current budget with your previous budgets. We can calculate funding advances and actual-to-budget cost variances. With us maintaining your project accounting requirements, you can get feedback on the important decisions that you have made. Keep a track on the financial progress of your project with project accounting or job cost accounting. Since a project may last from a few weeks to many years, your budget may also get revised. We can create financial reports for your projects that can help you in project management.